Hi all,

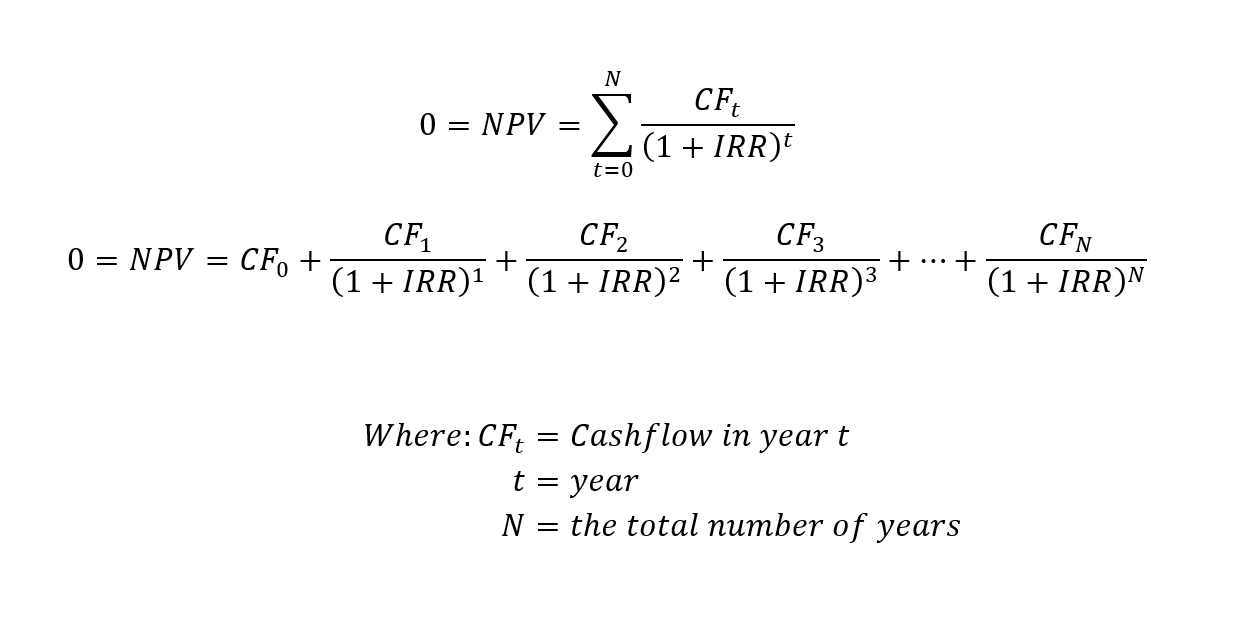

I’m looking for assistance with calculating the Internal Rate of Return (IRR) in FME for a dataset containing annual cash flows grouped by a RecordID attribute.

I’ve attached a sample CSV file ("Annual_cashflows_by_RecordID") that includes the data I’m working with. Each RecordID represents a unique group of annual cash flow amounts. My goal is to calculate the IRR for each RecordID.

From my research, it seems the best approach is to use a PythonCaller transformer, but I’m not familiar with Python coding or how to configure this transformer for the task.

If anyone has experience with similar calculations or can provide guidance on setting up the necessary transformers (or Python script), I would greatly appreciate your help!

Cheers,